modified business tax nevada due date

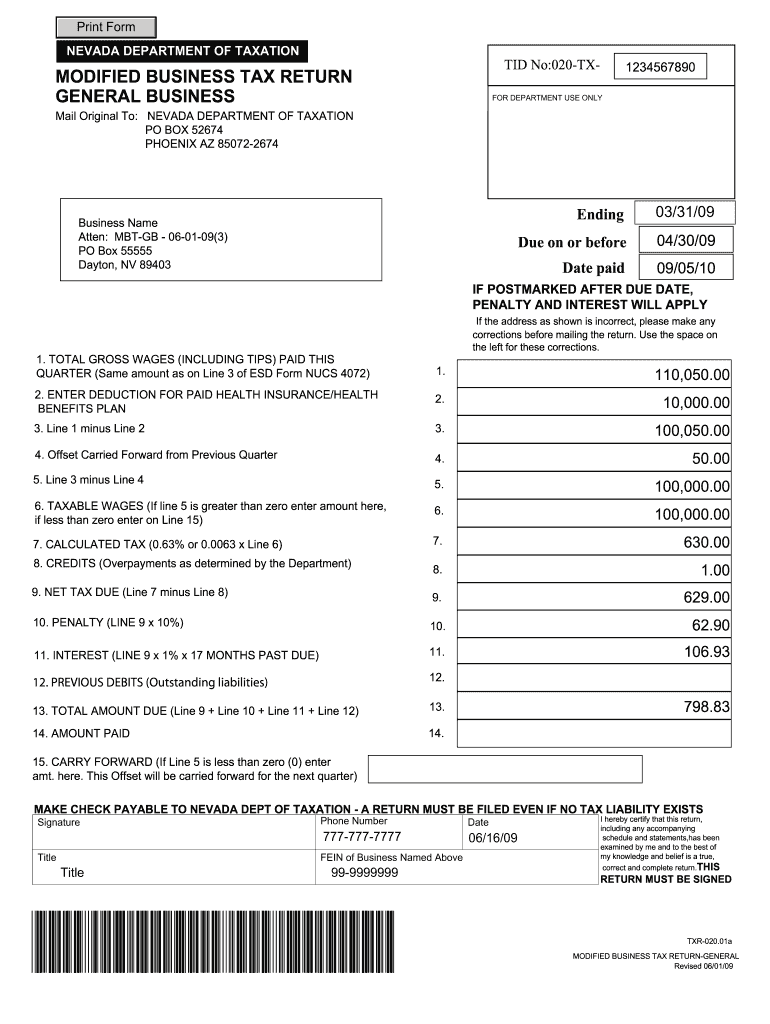

Businesses or individuals may pay its delinquent tax online using a credit card or debit. If postmarked after due date penalty and interest will apply a return must be filed even if no tax liability exists sales tax enter amounts in county of salesuse or county of delivery total sales tax.

Their hours are 7am to 7pm Monday through Friday Pacific Time.

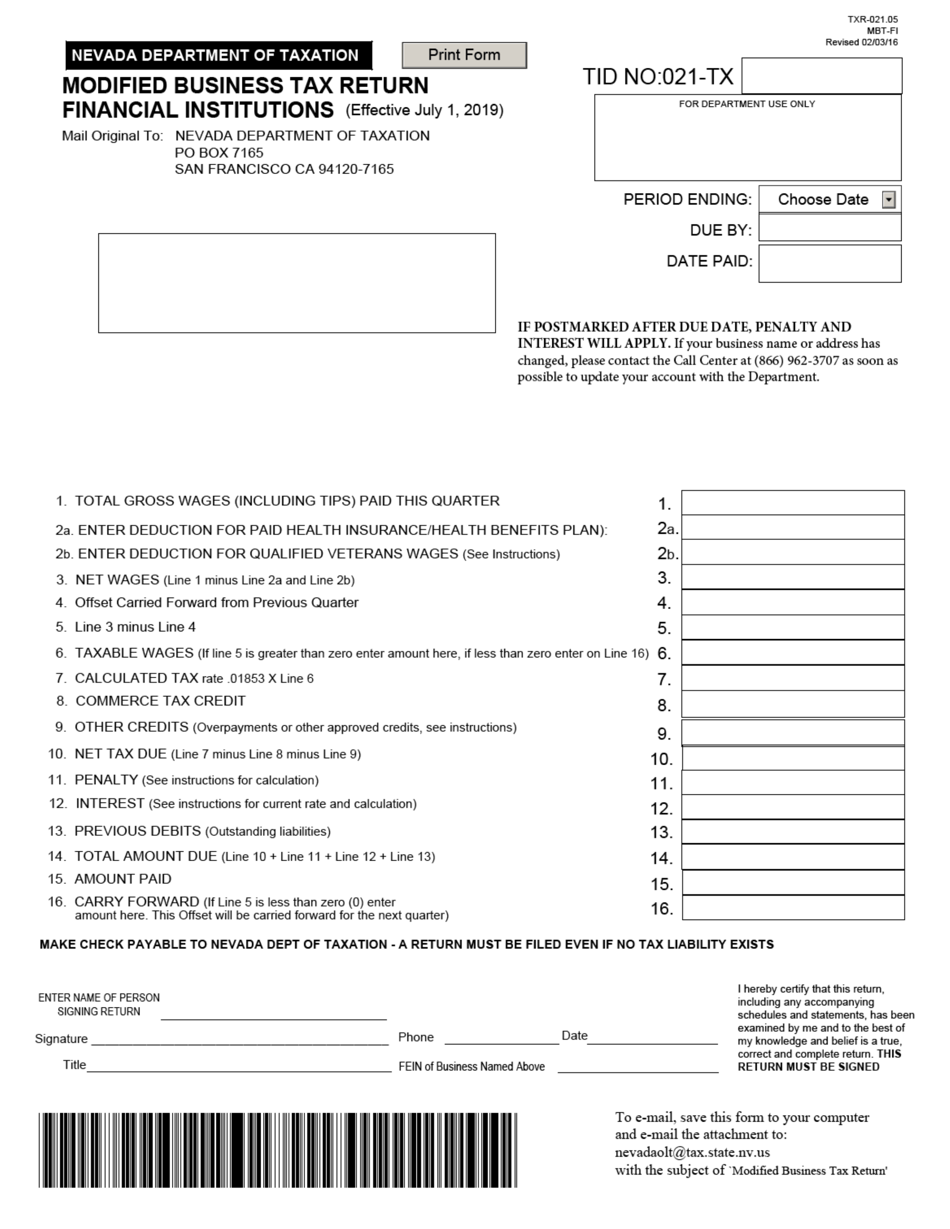

. Q2 Apr - Jun July 31. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. If your business name or address has.

How to Edit Your Modified business tax return nevada Online Easily and Quickly. This typically happens in April July October and especially January which coincides with the due dates of monthly quarterly and sometimes annual returns. Nevada City CA 95959.

The collection of bond contributions began with the first quarter 2014 with a due date of April 30 2014 and will continue to be collected quarterly from employers until the bonds are fully repaid in late 2017 or early 2018. Nevada Modified Business Tax Form Pdf. Forms and payments have to be mailed or hand delivered to one of the four district offices of the Nevada Department of Taxation.

Modified business tax return. Q1 Jan - Mar April 30. San francisco ca 94120-7165.

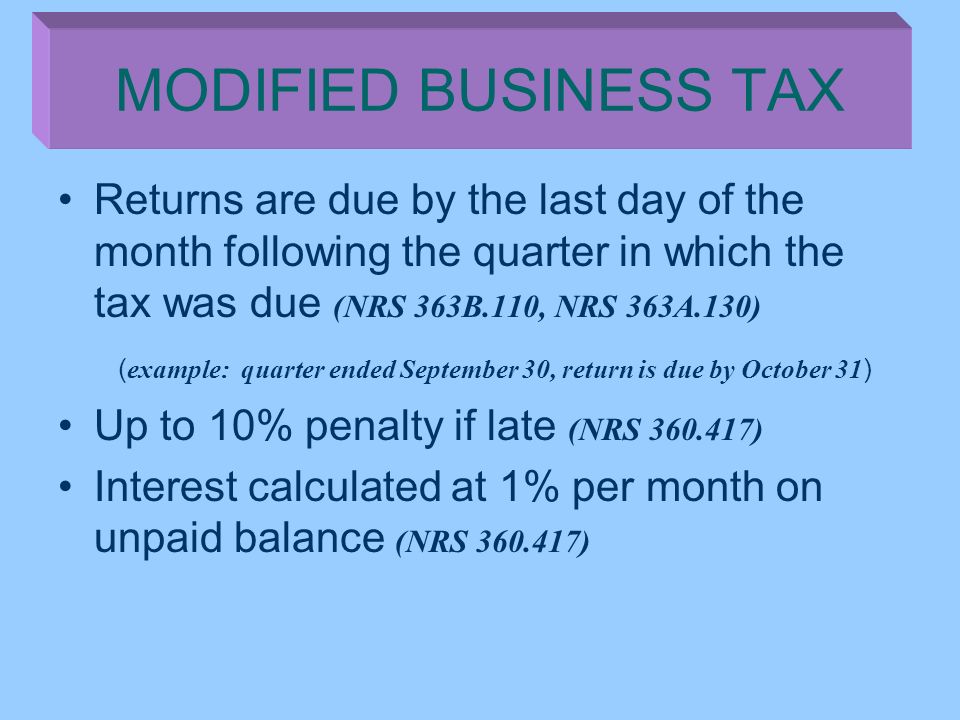

Do not enter an amount less than zero. Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below. When Are the Forms and Tax Payments Due.

The default dates for submission are April 30 July 31 October 31 and January 31. The due dates are April 30 July 31 October 31 and January 31. Number of Months Late.

1 and ends on May 1. If payment of the tax is late penalty and interest as calculated. Nevada State Commerce Tax return is due between the end of the taxable year July 1st and the due date of the Commerce tax return - August 14th.

For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165. For additional questions about the Nevada Modified.

If the business ceased to exist before the end of the taxable year a short year return may be filed. If the sum of all taxable wages after health. It could take as long as 15 days for your check to clear your account.

Federal State Contact Information. For example the taxes were due January 31 but not paid until February 15. A tax return will still need to be filed by all employers even if the taxable wages are less than 50000 and tax due is 0.

Due to increased returns and payments received processing can take longer than normal. Clark County Tax Rate Increase - Effective January 1 2020. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in Nevada who may have an existing tax liability.

Interest - If this return will not be postmarked and the taxes paid on or before the applicable due date enter 1 001 times line 11 for each month or fraction of a month late. If you received a Commerce Tax Welcome Letter Click Here. Net Tax Due - Line 7 minus Line 8.

Forms and payments must be mailed to the address below. The number of days late is 15 so the penalty is 4. Line 6 Taxable wages is the amount that will be used in the calculation of the tax If line 5 is greater than zero this is the taxable wages If line 5 is lessLINE 10- If this return is not submittedpostmarked and taxes are not paid on or before the due date as shown on the face of this return the amount of penaltyLine 11 Interest - If this.

All forms and tax payments are due by the end of the month following the end of the four-month period. If you have any questions about state taxes you can contact the Nevada Department of Taxation at 866-962-3707. Quarterly Tax Return Due Date.

The result is the amount of penalty that should be entered. If the due date falls on a weekend or holiday the return is due on the next business day. 12 rows Due Date Extended Due Date.

For example if the taxes were due January 31 but not paid until February 15. Review filing payment history. This amount is due and payable by the due date.

If you have any questions about federal taxes you can contact the IRS at 800-829-4933. NEVADA DEPARTMENT OF TAXATION PO BOX 52609 PHOENIX AZ 85072-2609 TID No020-TX PERIOD ENDING. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

The number of days late is 15 so the penalty is 4. NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS Mail Original To. General business effective july 1 2015 for department use only.

For example the tax return and remittance for October 1 2006 through December 31 2006 was due on or before January 31 2007. The amnesty period will begin Feb. Enter your Nevada Tax Pre-Authorization Code.

Easily fill out PDF blank edit and sign them. TOTAL AMOUNT PAID NEVADA DEPARTMENT OF TAXATION PO BOX 52674 PHOENIX AZ. Complete Nevada Modified Business Tax Form 2020 online with US Legal Forms.

Cannabis Business Tax Quarterly Return. If postmarked after due date penalty and. Click here to schedule an appointment.

Generally the due date is August 14. SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. TOTAL AMOUNT DUE Line 9 Line 10 Line 11 Line 12 FEIN of Business Named Above FINANCIAL INSTITUTIONS DO NOT DETACH COUPON STATE OF NEVADA MODIFIED BUSINESS TAX COUPON - FINANCIAL INSTITUTION License Number.

Nevada department of taxation po box 7165. Tax for each calendar quarter is due on the last day of the quarter and is to be paid on or before the last day of the month following the quarter. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately.

Ask the Advisor Workshops. Taxable wages x 2 02 the tax due. Additionally the new threshold is decreased from 85000 to 50000 per quarter.

NRS 612 is also subject to the Modified Business Tax. When is the tax due. IF POSTMARKED AFTER DUE DATE PENALTY AND INTEREST WILL APPLY If the address as shown is incorrect please make any.

For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. The last day of the month following the applicable quarter.

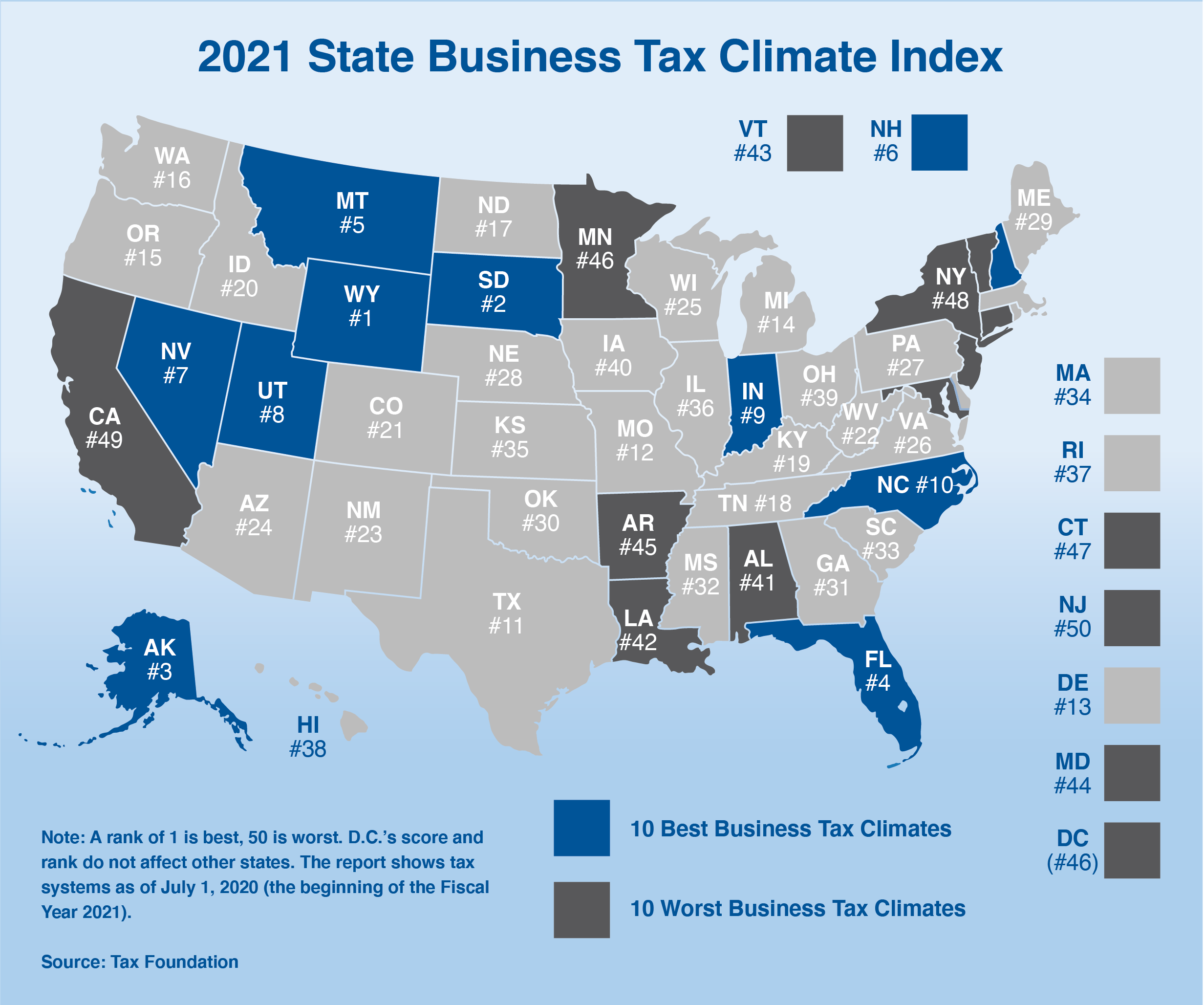

What Is The Business Tax Rate In Nevada

State Of Nevada Department Of Taxation Ppt Video Online Download

State Of Nevada Department Of Taxation Ppt Video Online Download

Does Qb Offer The Nv Modified Business Tax Payroll Form

Altered State A Checklist For Change In New York State Empire Center For Public Policy

Get Nevada Modified Business Tax 2020 2022 Us Legal Forms

Tax Day Irs Pushes 2020 Tax Filing And Payment Due Date From April 15 2021 To May 17 2021 Abc7 San Francisco

How To File And Pay Sales Tax In Nevada Taxvalet

State Of Nevada Department Of Taxation Ppt Video Online Download

How To File And Pay Sales Tax In Nevada Taxvalet

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller