san antonio sales tax rate 2019

Did South Dakota v. San Antonios current sales tax rate is 8250 and is distributed as follows.

Pin By Angela Grant On Recipes Ultra Violet Ladera Personalized Items

Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825.

. The minimum combined 2022 sales tax rate for San Antonio Texas is. There is no applicable city tax or special tax. The San Antonio sales tax rate is.

Contents Local sales taxes. Next to city indicates incorporated city City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc. There is no applicable county tax.

This rate includes any state county city and local. The average cumulative sales tax rate in San Antonio Texas is 822. Abilene Taylor Co 2221012020000082500.

Antonios educational shortcomings which are at the heart of the citys nearly. 2018 rates Zip code 78216 2019 sales tax fact 89 zip codes Special sales tax San antonio turned The latest sales tax rate for San Antonio TX. San Antonio has parts of it located within Bexar County and Comal County.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. You can print a 7 sales tax table here. The December 2020 total local sales.

0250 San Antonio ATD Advanced Transportation District. The San Antonio Texas general sales tax rate is 625. The 78216 San Antonio Texas general sales tax rate is.

127 rows Nineteen major cities now have combined rates of 9 percent or higher. It spans 10 days. Within San Antonio there are around 82 zip codes with the most populous zip code being 78245.

The Florida sales tax rate is currently. This is the total of state county and city sales tax rates. An additional 1 for each of the following 4 months.

For tax rates in other cities see Florida sales taxes by city and county. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. This is the total of state county and city sales tax rates.

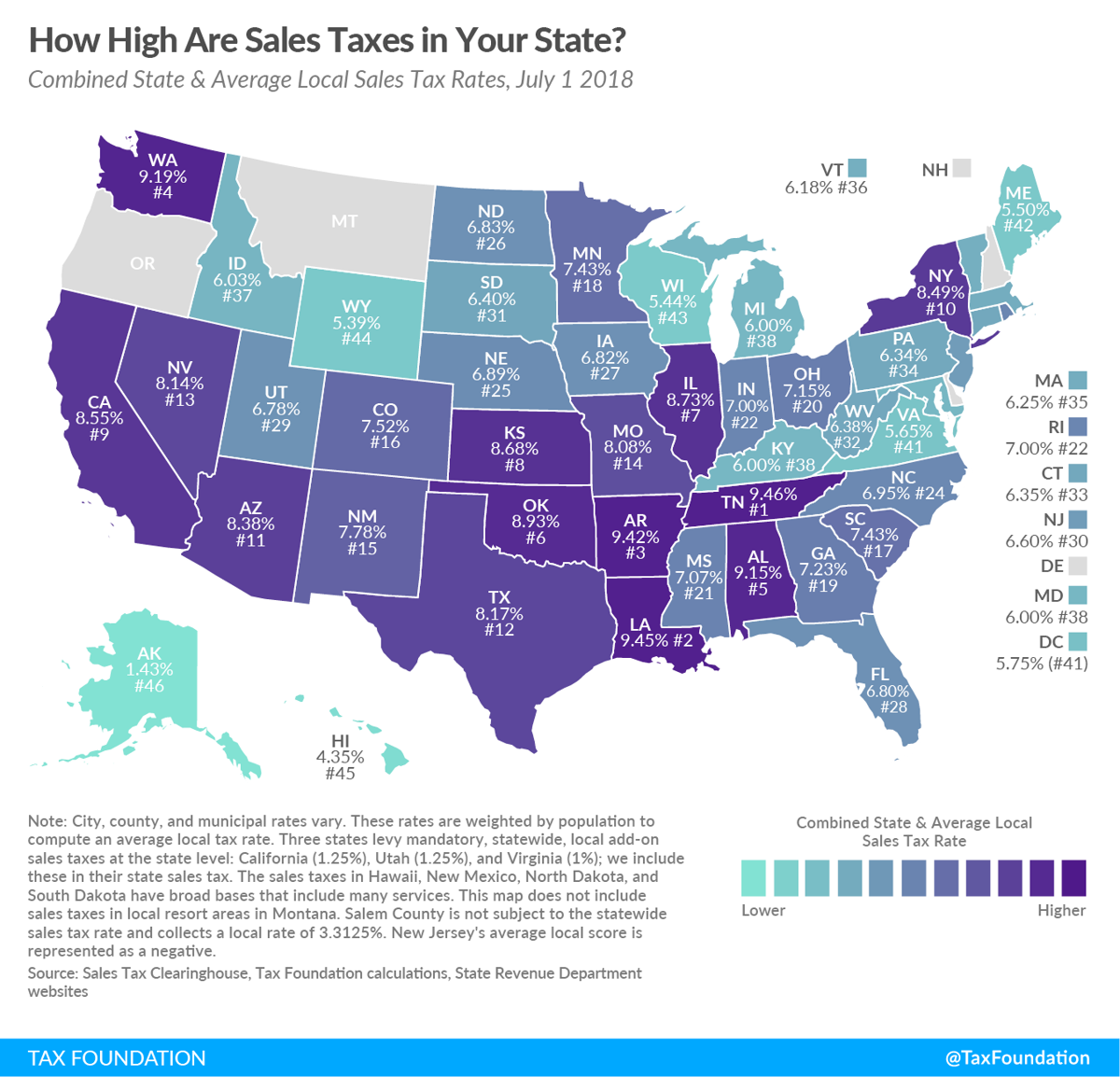

Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. 0125 dedicated to the City of San Antonio Ready to Work Program. In addition to interest delinquent taxes incur the following penalties.

This includes the rates on the state county city and special levels. Did South Dakota v. 6 for the first month.

California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note. Download all Texas sales tax rates by zip code. A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent.

The zone was established in 2000 to. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc.

The San Antonio sales tax rate is. The San Antonio Texas general sales tax rate is 625. San Antonio has a higher sales tax than 100 of Texas other cities and counties.

The minimum combined 2022 sales tax rate for San Antonio Florida is. The current total local sales tax rate in San Antonio TX is 8250. And that week isnt just one week long.

San antonio city council approved on Thursday the sale of five properties it owned in. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. 0250 San Antonio ATD Advanced Transportation District.

Abilene Jones Co 2221012020000082500. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. The Texas sales tax rate is currently.

You can print a 825 sales tax table here. 1000 City of San Antonio. What is the sales tax rate in San Antonio Florida.

Sales Tax Rate Changes in Major Cities. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. San antonio texas sales tax rate 2019 San Antonio Texas knows how to party.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. It doesnt just do one fiesta. In 2019 Fiesta Week will be held from Thursday April 18.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The County sales tax rate is. The County sales tax rate is.

0500 San Antonio MTA Metropolitan Transit Authority. San Antonio TX Sales Tax Rate. And an additional 2 for the sixth month for a total of 12.

The minimum combined 2020 sales tax rate for San Antonio Texas is 825. Local Rate Total Rate. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2.

It does a whole Fiesta Week. This is the total of state county and city sales tax rates. What is the sales tax rate in San Antonio Texas.

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Texas Sales Tax Guide For Businesses

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Graciegene S Boutique San Antonio Tx Boutique Window Clearance Sale Poster Sale Poster Sale Signage

Understanding California S Sales Tax

Texas Sales Tax Guide And Calculator 2022 Taxjar

Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Understanding California S Sales Tax

Why Are Texas Property Taxes So High Home Tax Solutions

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled